The airfreight industry plays a key role in Africa due to the vast and challenging geography of the continent, connecting businesses and supporting economic growth. As opportunities increase and focus increasingly turns to the region, the demand for airfreight services is only likely to grow.

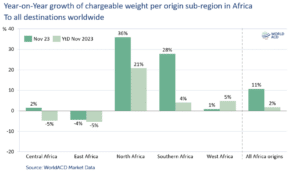

Based on the largest and most comprehensive air cargo database in the industry, WorldACD recently conducted thorough analysis of international air freight to and from Africa. WorldACD’s unique product-level and agent-level market data enables to provide the most accurate and up-to-date market data, based on 2 million worldwide shipments per month. According to WorldACD Market Data, worldwide air cargo originating in Africa continues to grow: overall tonnages from Africa increased +2% Year-to-Date Nov 2023 compared to the equivalent period in 2022.

READ: Full year 2023 ends at -5%, year on year

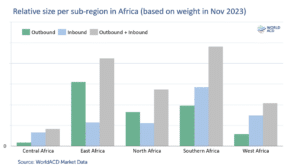

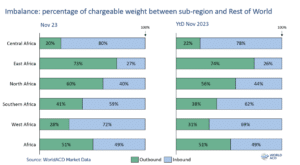

Figures of November 2023 indicate that both sub-regions East Africa and North Africa have seen higher volumes outbound compared to inbound. Sub-regions Central Africa, Southern Africa, and West Africa on the other hand, experienced similar directional imbalances, albeit in the opposite direction, with inbound tonnages exceeding outbound tonnages. Central Africa accounts for roughly 2% of the total outbound and inbound tonnages from and to Africa. In comparison, outbound and inbound tonnages from and to Southern Africa account for over 40% of Africa’s total chargeable weight in November 2023.

READ: Airfreight tonnages in Q4 2023 closed up 3%

Air cargo originating in Africa continues to grow. Chargeable weight from North Africa in 2023 (YtD Nov) increased +21% compared to YtD Nov 2022. Southern Africa and West Africa have seen YoY growth of +4% and +5% respectively. However, outbound tonnages from both Central Africa and East Africa decreased -5% compared to YtD Nov 2022. The chargeable weight of all African origin regions (YtD Nov 2023) increased +2% compared to the YtD Nov 2022.

READ: Rates bounce back to +50% above pre-Covid levels

African airlines account for +30% of total outbound air cargo from Africa. The market share of African airlines per sub-region varies from 19% and 20% in Southern and West Africa, to 25% and 29% in Central and North Africa. African airlines had a market share of 38% of total outbound chargeable weight from East Africa.

READ: Peak-season air cargo tonnages up 3% on last year

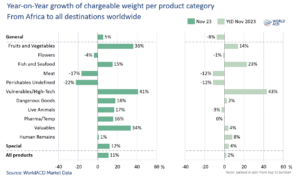

Zooming in on individual air cargo product categories is crucial for understanding rates and the development of air cargo markets. This is also the case for Africa, where 80% of outbound business and 30% of inbound business relates to special products.

Most special product categories have shown positive YoY growth rates for Africa’s outbound air cargo business. Total outbound tonnages of fruits and vegetables from Africa have increased +14%, and +23% in the category of fish and seafood. Several product categories show decreased YoY growth, ranging from flowers -1% and live animals -3%, to meat and perishables undefined both -12%.

Overall special product growth from Africa was up +4% YtD Nov 23, whereas the general cargo from Africa decreased with -8%

READ: Rates ex-Asia Pacific continue strong rise

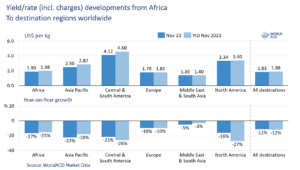

USD yield/ rates from Africa have fallen significantly with -12% (YtD Nov 2023), with decreases to all destination regions. Outbound air cargo yield/rates to the Middle East & South Asia decreased -3%, whilst rates for North America and Central & South America decreased -27% and -26% respectively. Rates from Africa to Europe decreased -10% and Asia Pacific -18%. Similarly, rates within Africa decreased -15% YoY.

READ: Thanksgiving air cargo tonnage decline less severe than last year

Directional imbalances of worldwide trade are among the biggest challenges to overcome in global supply chains. Airlines operating in Africa also face challenges due to this imbalance between outbound and inbound. In some of Africa’s sub-regions only a relatively small percentage of air cargo is meant for export (outbound business).

Roughly 31% of West Africa’s total chargeable weight YtD Nov 2023 was accounted for by outbound, whilst the remaining 69% was inbound. In Central Africa, outbound represents an even lower percentage of 22% compared to 78% inbound. On the other hand, inbound in East Africa accounts for as little as 26% of the total chargeable weight, against 74% outbound. North Africa is the most balanced sub-region of Africa given its 56% inbound vs. 44% outbound ratio. In other words, directional imbalances vary from sub-region to sub-region in Africa, but the share of outbound and inbound in total tonnages from and to Africa as a region (YtD Nov 2023) is balanced with 51% vs. 49%.